The Envision Process

Invest with Purpose

The Envision process® can help bring new clarity to your life goals and enhance your confidence in your ability to achieve them.

The Envision process, offered through your First Clearing brokerage account, provides you with the tools and technology needed to prioritize your life goals, decide on an appropriate investment strategy, track your progress and re-sync - or rethink - your approach whenever necessary.

It All Starts with Your Needs

The Envision process's interactive approach can help you identify:

- Where you are now financially

- Where you want to go

- How you plan to get there

Your Envision plan will take the following into account:

- Life goals

- Education goals

- Assets

- Liabilities

- Cash-flow requirements

- Retirement planning needs

- Levels of acceptable investment risk

- Asset allocation objectives

This allows your B. Riley Wealth Management financial advisor to help you strategically allocate your portfolio based on your needs and situation*.

*Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns.

Your Personal Benchmark: "The Dot"

The centerpiece of your Envision investment plan is a personalized benchmark called "the dot." Instead of tracking your portfolio's performance against a major standardized index, such as the S&P 500, your financial advisor uses the dot to monitor your progress toward achieving your life goals.

While tracking an index lets you gauge market trends and relative performance, what's more important is how well your investments are helping you work toward achieving your personal goals. Your B. Riley Wealth Management financial advisor can update you on your dot's progress as frequently as you want - weekly, monthly or annually.

The Envision process also offers you the flexibility to adjust your priorities, if necessary, based on fluctuating market conditions or life-changing events.

Tracking Progress and Minimizing Risk

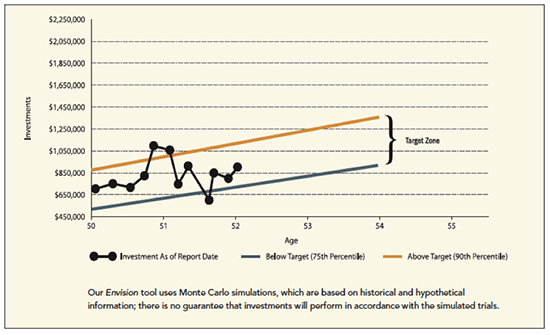

Envision technology uses a powerful statistical modeling technique to help confirm you are in the right "target zone" to achieve your life goals, without unduly sacrificing your current lifestyle needs or being exposed to unnecessary risk. When your personal benchmark moves out of the target zone or your personal situation changes, your B. Riley Wealth Management financial advisor will work with you on adjustments to your plan, such as modifying savings rates or reallocating assets, to get your investment plan back on target.

The Envision process lets you and your financial advisor look at your profile on a regular basis and make sure that you are staying on track. Keeping your dot within the target zone helps ensure you're working toward your goals without making undue sacrifices or taking unnecessary risk.

Will You Have Enough?

The Envision process gives you and your B. Riley Wealth Management financial advisor the flexibility to adjust your profile to account for any of life's changes, such as:

- Increasing medical costs

- Marriage or divorce

- Helping a child or grandchild afford higher education

- Caring for an elderly parent

- Starting a second career

- Inheriting money or other assets

When things change, simply contact your B. Riley Wealth Management advisor to ensure that your Envision profile keeps pace with your life.

IMPORTANT: The projections or other information generated by Envision regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Envision methodology:

Based on accepted statistical methods, the Envision tool uses a simulation model to test your ideal, acceptable and recommended investment plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. These assumptions were derived from analysis of historical data. Using Monte Carlo simulation the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation among the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between.

Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management, Inc. and Wealthcare. Capital Management IP, LLC © 2004-2014 Wealthcare Capital Management, Inc., and Wealthcare Capital Management IP, LLC. All Rights Reserved. Wealthcare Capital Management, Inc., and Wealthcare Capital Management IP, LLC are separate entities and are not directly affiliated with First Clearing, LLC. Envision® is a registered service mark of Wells Fargo & Company and used under license. Brokerage account(s) carried by First Clearing. First Clearing is a trade name used by Wells Fargo Clearing Services, LLC, Member SIPC, a registered broker-dealer and non-bank affiliate of Wells Fargo & Company. ©2012-2015 Wells Fargo Clearing Services, LLC. All rights reserved.