Areas of Expertise

- Asset Valuations

- Corporate Transactional Advisory

- Field Examination Services

- Retail/Consumer Lending & Disposition

Business Securities

- Bankruptcy and Distressed Businesses

- Business Case Development and Feasibility

- Corporate Stock Buy-back Transactions

- Evaluation of Purchase Offers

- Evaluation of Sale Offers

- Financial Reporting

- Financing Transactions

- Gift and Estate andTax Planning

- Goodwill Impairment Testing

- Insurance Underwriting

- IP Licensing Arrangements

- Property Tax, Transfer Pricing and Other Tax Purposes

- Purchase Price Allocation

- Sales Utility Tax Exemption

- Stock Options

- Transactions Involving Partners and Shareholders

Fixed Asset Advisory

- Compliance & Reporting

- Tax Services

- Transaction Due Diligence & Risk Management

Intangible Assets

- Brands

- Contracts

- Copyrights

- Customer Lists

- Domain Names

- Patents

- Resource Rights

- Royalty Streams

- Trade Names

- Trademarks

Inventory

- Automotive

- Building Products

- Energy

- Food

- Grocery

- Home Furnishings & Home Improvement

- Metals

- Paper & Packaging

- Retail

- Wine & Spirits

Machinery & Equipment

- Construction

- Heavy Mobile

- Metalworking

- Oil & Gas

- Plastics Processing

- Textiles

- Transportation

Operations Management

- CEO/COO/Interim Management

- Due Diligence for Acquisitions

- Operational Turnarounds

Education

- Bentley University

Biography

Ryan Mulcunry serves as Managing Director for B. Riley Financial specializing in retail/consumer lending and disposition. A trusted advisor to financial institutions, private equity and professional services firms, Ryan works closely with clients to advise on appropriate credit structures for lending and transactional purposes.

Over the course of his nearly 20-year tenure with the company, he has conducted thousands of appraisals in the retail, wholesale and industrial sectors and is recognized for his deep expertise in emerging retail and consumer industry trends.

He specializes in providing asset valuations for inventory, machinery & equipment, real estate and intellectual property/intangible assets, and provides corporate transactional advisory services such as fairness opinions, solvency opinions, and pre-transaction valuation analyses.

In addition to the appraisal work that Mulcunry is involved in on a daily basis, some high profile dispositions which he was involved in are:

- Payless Shoe Stores, closure of 2,100 stores

- Gymboree, closure of 749 stores

He is a board member of the Turnaround Management Association (TMA) and the Association for Corporate Growth (ACG) and frequently speaks at industry conferences.

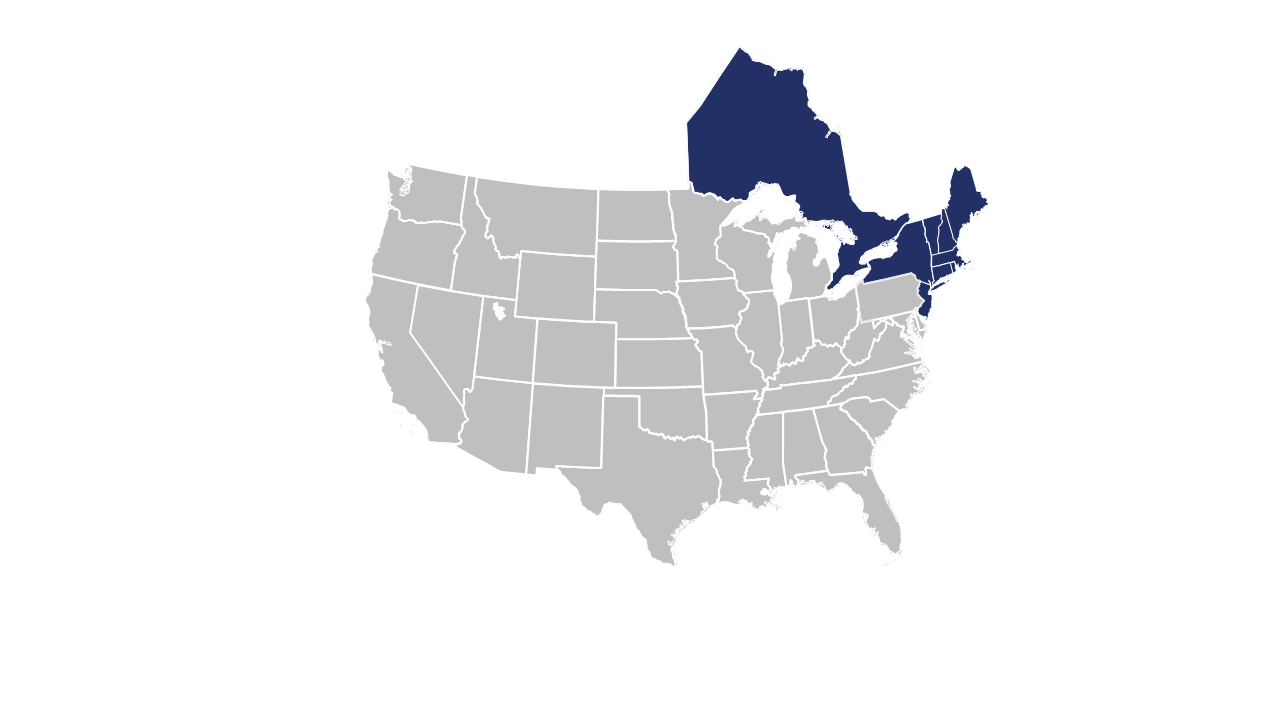

Mulcunry earned a B. S. in Finance from Bentley College. He is responsible for overseeing client relationships in New England, upstate NY and Canada including Toronto, Ontario and Quebec.